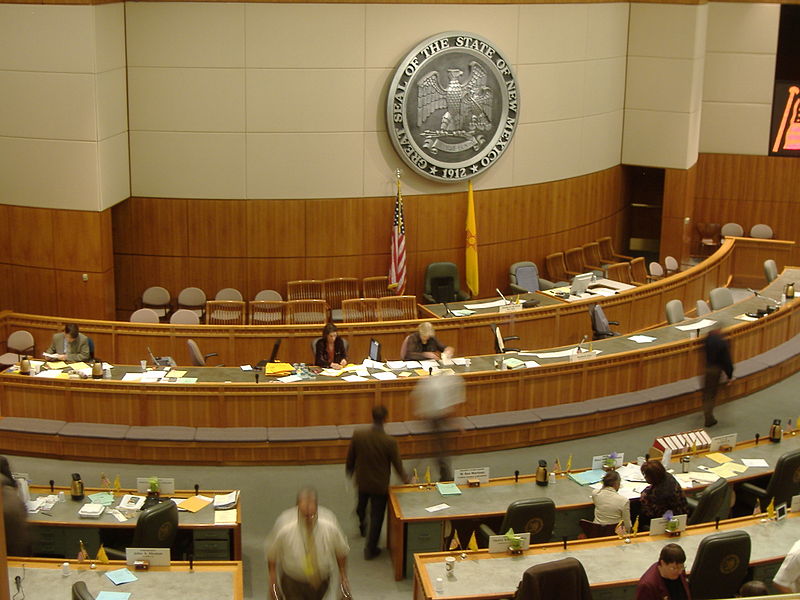

While state lawmakers are pulling out all the stops to find “now money” to plug an expected deficit in the next fiscal year, Rep. Jason Harper has introduced a bill he hopes can put the state on better financial footing for decades to come.

Harper, R-Rio Rancho, admits that House Bill 412, the New Mexico Tax Reform Act, is not a quick fix and will not patch the budget in fiscal year 2018 or even 2019. But by restructuring the state gross receipts tax and simplifying income and other tax policies, New Mexico will position itself for more solid growth in the new economy, he said.

“It doesn’t help us fix the current budget problem,” Harper said of his bill, “but this hopefully prevents another budget problem.”

The measure comes halfway through the 2017 legislative session, when reserve funds have been depleted by efforts to balance budgets for the last fiscal year and the current year, which ends in June, and many lawmakers are focused on raising enough new money to get through the upcoming year.

After thousands of hours of data crunching, the more than 300-page bill proposes bringing back the gross receipts tax on food, but at a lower rate statewide, somewhere below 3 percent. Those receiving food assistance would be exempted from the tax, Harper said, and the bill increases tax credits to low-income residents.

The bill eliminates most other exemptions to the gross receipts tax — including loopholes for nonprofits and internet sales. It rebrands the tax it as a sales tax.

Additionally, the bill provides for a single rate of 5 percent for both corporate and personal income tax, and makes changes that send more money to the road fund, as well as local governments and Medicaid.

The simple 5 percent tax rate is used by the state of Utah, which ranks high for state tax structures, Harper said.

Harper, an engineer with three scientific patents, has been compiling data and running spreadsheet models since the end of the last legislative session. He also has presented the information to business and industry groups and interim legislative committees, including the Legislative Finance Committee.

He said lawmakers in both parties are stuck with an outdated tax code that is clearly not working and a governor who is refusing to sign measures that would boost revenue. “The only way is to get a comprehensive reset,” he said.

His outreach has paid off, with two senior Democrats agreeing to co-sponsor the bill: Sen. John Arthur Smith of Deming, chairman of the Senate Finance Committee, and Sen. Carlos Cisneros of Questa, co-chairman.

“I think that’s the only true tax reform that’s out there, and I thing that the discussion needs to carry forward,” Smith said.

Progressives in the Democratic Party have said any reintroduction of a tax on food is a nonstarter, Smith said. But he said those same lawmakers lament cuts to public education, not understanding that removing the gross receipts tax from food is costing the state $400 million a year, money that could pay for schools.

“They are saying never a tax on food,” Smith said, “but they want to help education. I think the food tax is going to have to be discussed.”

Explaining the complicated tax measure might be Harper’s biggest obstacle. The bill, for instance, does not initially set an absolute sales tax rate for the state until data are gathered on economic sectors that might not be paying taxes today.

That information will be crunched the first year the bill becomes law, with no changes until a full analysis is completed.

“We spent thousands of hours developing a tax tool [available online] that allows us to calculate the new rate based on a revenue neutral change to the tax code,” Harper said. “Our calculations show that the state GRT rate will fall from 5.125 percent to approximately 2.7 percent if HB 412 is enacted.

He said that rate is based on a very conservative calculation, and after initial implementation, the state rate would be adjusted again. “We expect the state rate will again decrease, falling below 2.7 percent.”

Contact Bruce Krasnow at [email protected].