Sick Days Ahead: Cutting through vaccine misinformation to get cold, COVID season facts for New Mexicans

Amid all the confusion and misinformation, The Paper. and New Mexico Political Report checked the facts to help readers understand what this year’s flu and COVID season looks like and when, where and how to get vaccinated, if they choose.

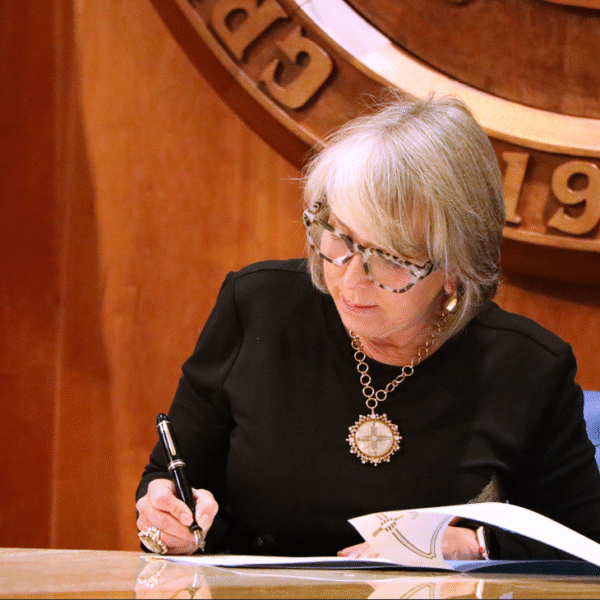

Public Service, Private Profits.

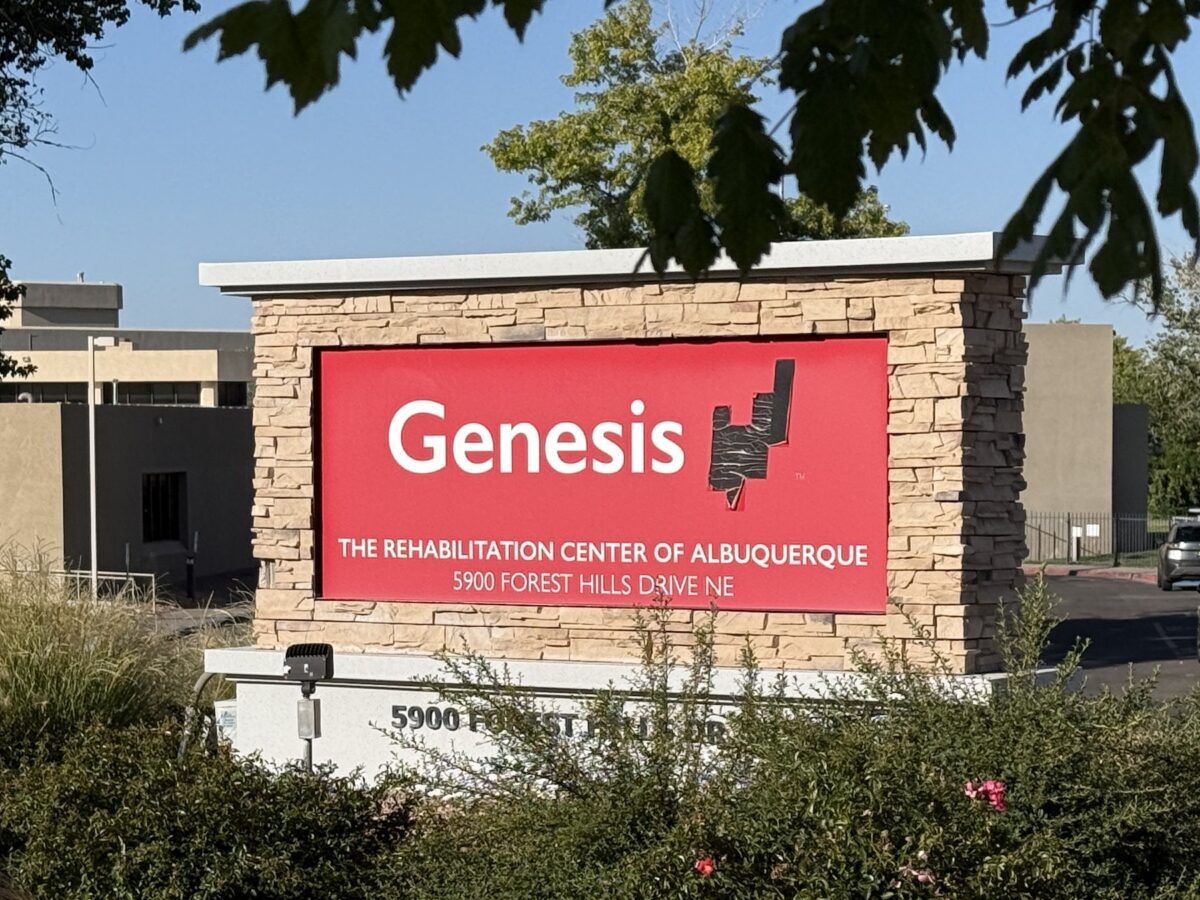

Private equity, public harm: Genesis seeks bankruptcy to avoid accountability for staffing, neglect and deaths in New Mexico nursing homes

After a private equity cash-out and paying millions in CEO bonuses, Genesis Health tells a bankruptcy court it can’t afford to pay $259 million in malpractice costs

LATEST REPORTS

‘Systematic failure’ alleged in lawsuit against Albuquerque health facility after resident’s death

After a private equity cash-out and paying millions in CEO bonuses, Genesis Health tells a bankruptcy court it can’t afford…

800 days without basic nursing care: Nursing home lawsuit alleges neglect in troubled Bloomfield facility

After a private equity cash-out and paying millions in CEO bonuses, Genesis Health tells a bankruptcy court it can’t afford…

Private equity, public harm: Genesis seeks bankruptcy to avoid accountability for staffing, neglect and deaths in New Mexico nursing homes

After a private equity cash-out and paying millions in CEO bonuses, Genesis Health tells a bankruptcy court it can’t afford…