Tax revenues across the state are plummeting in the wake of the COVID-19 pandemic, and municipalities are struggling to plug holes in their budgets. For its part, Santa Fe expects a $46 million shortfall for fiscal year 2020, much of it stemming from an immense drop in revenue from the Gross Receipts Tax (GRT). Austerity measures like a spending freeze and the release of temporary employees along with tapping the city’s reserve funds still leaves Santa Fe officials with about $16.5 million unaccounted for.

Fiscal year 2021, which begins on July 1, looks even more dire; city officials are expecting a $100 million shortfall.

There is another option for raising revenue, however.

According to a study by the New Mexico Department of Finance and Administration (DFA) from 2018, Santa Fe charges less than half of what the state allows for property taxes. If they taxed residential and non-residential property at their full authority, the City Different could shrink the gap considerably, or even close it.

Santa Fe uses only 41.1 percent of its available property tax authority, according to numbers from DFA. Based on projected property tax revenue in Santa Fe’s 2020 budget, the city could generate $18.1 million in additional revenue by utilizing its full authority, although that number is only a rough estimate and would likely be lower because of potential deferments as a result of the crisis.

Even still, it could help address the deficit that Santa Fe finds itself in.

The city’s estimated shortfalls are subject to change as well. The Santa Fe New Mexican reported an $18 million deficit on April 20, rather than what Webber is now saying will be $16.5 million.

“We won’t have a really hard number until August,” Webber said, due to the lag in GRT revenue, which is distributed by the state.

Santa Fe’s 2020 budget proposal projected property taxes to generate $13.1 million in property taxes for the upcoming fiscal year, as opposed to the expected revenue from GRT, $112.1 million. Almost a third of the city’s projected revenue this year was expected to come from GRT, a revenue stream that has collapsed because the tax is levied on businesses every time they sell a product or service.

GRT excludes food and medicine, which Webber points out are two of the only things that people are buying in ordinary quantities amid widespread fears of infection and closed businesses.

“Retail, entertainment, anything involving people gathering,” Webber said. “They’re facing huge losses.”

But Webber admits that Santa Fe property taxes are below where they are allowed to by the state.

Property tax revenue is split mainly between counties and municipalities, with slightly more going to counties and a small portion going to school districts.

One solution that Webber would like to see to increase revenue would be to amend a controversial rule that limits property tax increases based on length of ownership.

Referred to as tax lightning, the rule restricts property tax increases to 3 percent year over year, unless the property is sold. Originally billed as a measure to protect longtime residents, often intergenerational homeowners who faced untenable property tax bills as a result of skyrocketing valuations in gentrifying neighborhoods, one side effect of the 2000 tax lightning law was artificially throttling the tax bills of wealthy homeowners across the state, even if they weren’t even living in the home for which they were getting a tax break.

State Representative Matthew McQueen,D-Galisteo, introduced an ultimately unsuccessful bill to limit tax lightning to properties that were “owner-occupied” in the 2019 and 2020 legislative session and requiring owners of properties where they did not live to pay property tax on the full market rate of the real estate.

Webber said implementing this change would go a long way to getting real estate owners using properties as second homes or investment properties to pay their fair share.

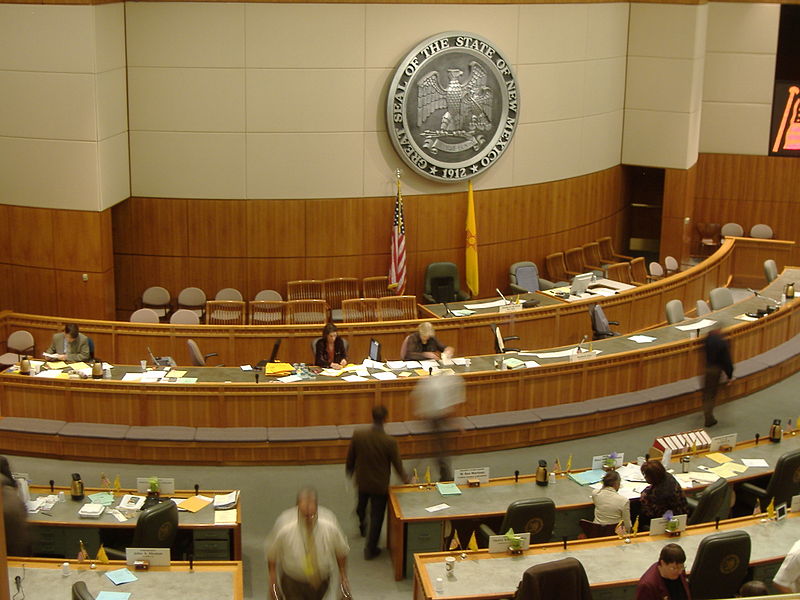

Unfortunately, such a move would require a vote by the state legislature, which has already convened for the year and such a change would be unlikely during an expected special session that will likely take place in mid-June.

Daniel Werwath, chief operating officer for New Mexico Inter-Faith Housing, has long been a supporter of the change, but said that it is both insufficient and incapable of addressing the crisis at hand.

Property taxes are far below where they should be, Werwath said, which has resulted in a tax system that is both inequitable and unstable.

Santa Fe’s reliance on GRT means that the bulk of the city’s revenue relies on average residents going out and spending on things like retail goods, as well as tourists coming into town and spending. GRT is similar to a sales tax.

“It’s certainly an issue that we don’t have a very diversified tax base,” Webber said, but added that raising property taxes during a pandemic and “a global meltdown akin to the Great Depression” was hard to imagine.

Good options are limited for Santa Fe, Webber said. Like many municipalities across the state and the country, federal assistance is the preferred course of action, but so far that help has been limited to cities with much larger populations and funds doled out through state governments, though state governments have their own budget shortfalls.

“I find reason to think that may change,” Webber said, pointing to continued work by Congress and an outcry by the United States Conference of Mayors, a group of 1,400 municipal executives of which Webber is a member, alongside Albuquerque Mayor Tim Keller and eight other New Mexico mayors.

Because tourism has collapsed and a huge number of local shoppers are sheltering in place, GRT is proving to be uniquely vulnerable to a crisis like the one presented by COVID-19.

“When you need local funding the most is when GRT is the least likely to be in excess,” Werwath said.

But even in good times, Werwath said, it puts far too much of the city’s tax burden on less well-off people who spend more of their money on things that contribute to GRT, and not enough on property owners.

Webber said that property taxes are regressive, meaning they fall more heavily on lower income people and less on those with greater wealth, and should therefore be carefully considered. This is a disputed point and one that Werwath disagrees with.

“Generally property taxes aren’t considered regressive,” Werwath said. They target property-owners, a class typically better off than those who do not own property. Webber said that one fear is pricing out “land-rich cash-poor” homeowners, or those who make little income and have little in savings but are living in expensive homes, perhaps because of increasing real estate prices in many neighborhoods in Santa Fe.

Webber admitted that property taxes were not necessarily less regressive than GRT, upon which the city relies much more heavily.

Werwath said that there are a few “land-rich cash-poor” homeowners left, but would prefer to simply offer them a tax abatement rather than structure Santa Fe’s entire tax structure around them.

“You could easily carve something out for those people,” Werwath said.

Another option the city has long considered is an internet sales tax charged to spending by residents online, through vendors like Amazon, based on the assumption that those buying goods via the internet are of greater means and are otherwise not impacted by taxes that would apply to local spending, namely GRT.

Werwath said he’s been agitating for a change in property taxes since the 2008 financial crash and before, to no avail.

“Now is absolutely the time to talk about this,” he added. “At a certain point we have to ask ourselves what kind of community we want, and whether we’re willing to pay for it.