By Alex Ross, Pat Davis, NM Political Report

A new Republican congressional candidate used a program enabling New Mexico disabled veterans to pay no property taxes on his Westside Albuquerque home while also purchasing a home out of state as his primary residence.

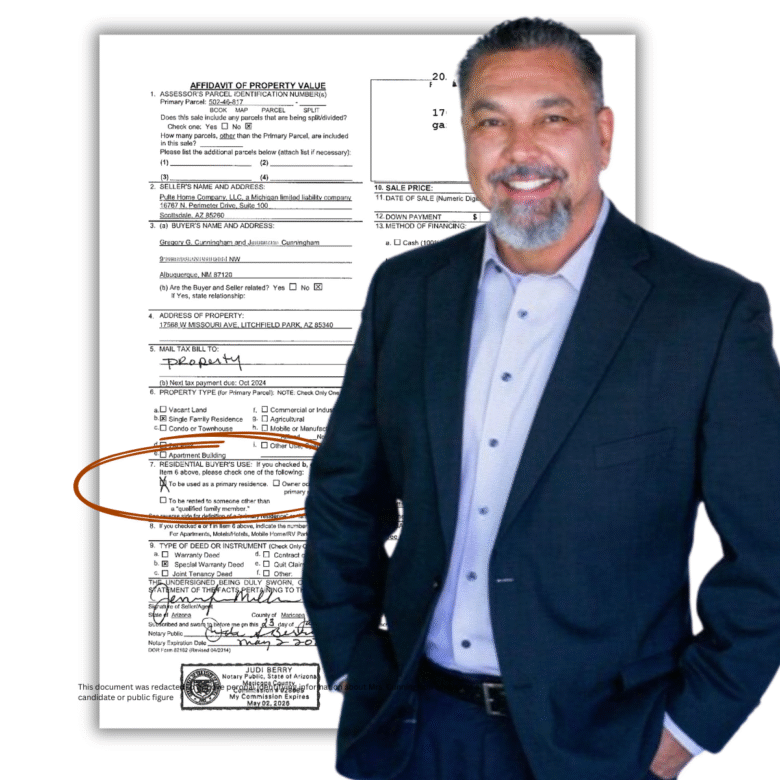

Gregory Cunningham, who this week filed the necessary paperwork with the Federal Election Commission to run for his party’s nomination to challenge U.S. Rep. Gabe Vasquez (D-NM-02) next year, is a disabled U.S. Marine veteran, who says his Westside Albuquerque home is, and always has been, his primary residence, despite paperwork that shows the same designation applied to an Arizona property he purchased in 2024.

The use of government-backed loans to purchase additional homes has been a hot topic in politics lately after President Trump ordered prosecutors to investigate Democratic officials who received mortgage benefits for primary residences they did not live in full-time.

“There’s a certain way you have to list it to get it done”

Reached by phone Friday morning, Cunningham confirmed that the Arizona home was not his residence, but he claimed it to be to access a Veterans Administration-backed loan program to help veterans purchase their primary residence at lower costs.

“There’s a certain way you have to list it to get it done,” Cunningham said. “It has since been turned into a rental property on paper, and Albuquerque has always been my residence.”

When questioned further, Cunningham said he has lived in Albuquerque since his childhood, and has resided at his current address in Albuquerque since 2016. He reiterated that he claimed the Arizona property as his primary residence in order to meet what were then Veterans Administration requirements to purchase it.

“That’s just again, VA guidelines, that’s the way you have to list things. And as soon as I could, per VA guidelines, change the status of that home, we did that,” he said.

Hours after concluding a phone interview with NMPR, Cunningham’s campaign manager sent an email claiming the Arizona home had been purchased for use while his wife was undergoing medical treatment, a fact Cunningham had never raised during the interview.

“After my wife was accepted into the Mayo Clinic, we purchased a second home in Arizona to stay in during her treatment. We followed the VA home loan rules, securing a Certificate of Eligibility which confirmed I was qualified to use my second-tier entitlement for the home,” said the statement attributed to Cunningham. “Thankfully, my wife responded well to treatment, and we recently converted that property to an investment property, again following VA guidelines.”

The VA Loan program

Cunningham’s use of a VA loan for the purchase is important because it allowed him to purchase the home with benefits that would not be available for a traditional first or second home mortgage. According to the VA, these loans help veterans access homes with “no down payment, competitively low interest rates, limited closing costs and no need for Private Mortgage Insurance (PMI).”

According to VA-loan Lenders Guidelines published by the Veterans Benefit Association, an agency of the VA, these loans cannot be used to purchase rental or second homes. “The veteran must certify that he or she intends to personally occupy the property as his or her home.” On an Affidavit of Property Value signed and notarized by Cunningham and his wife in January 2024, when asked to indicate the “residential buyer’s use,” the Cunninghams checked “Primary residence.”

VA guidelines allow a veteran to acquire a second home with a VA loan if their first home loan did not use all of their entitled benefit, a so-called “second-entitlement,” if the second home is used as a primary residence. Veterans United, a national VA Loan processor, explains that veterans can receive updated certificates with “bonus” or second tier benefit caps which can be used to purchase new primary residences if the buyer rents out the original home.

President Donald Trump has recently directed the U.S. Department of Justice to investigate several elected and appointed officials for falsely claiming additional homes as their primary residences in order to access preferential lending terms.

Mortgage documents obtained from the Bernalillo County Clerk show that Cunningham used a VA-loan to purchase his Westside Albuquerque home in 2016 and again for refinancing in 2020.

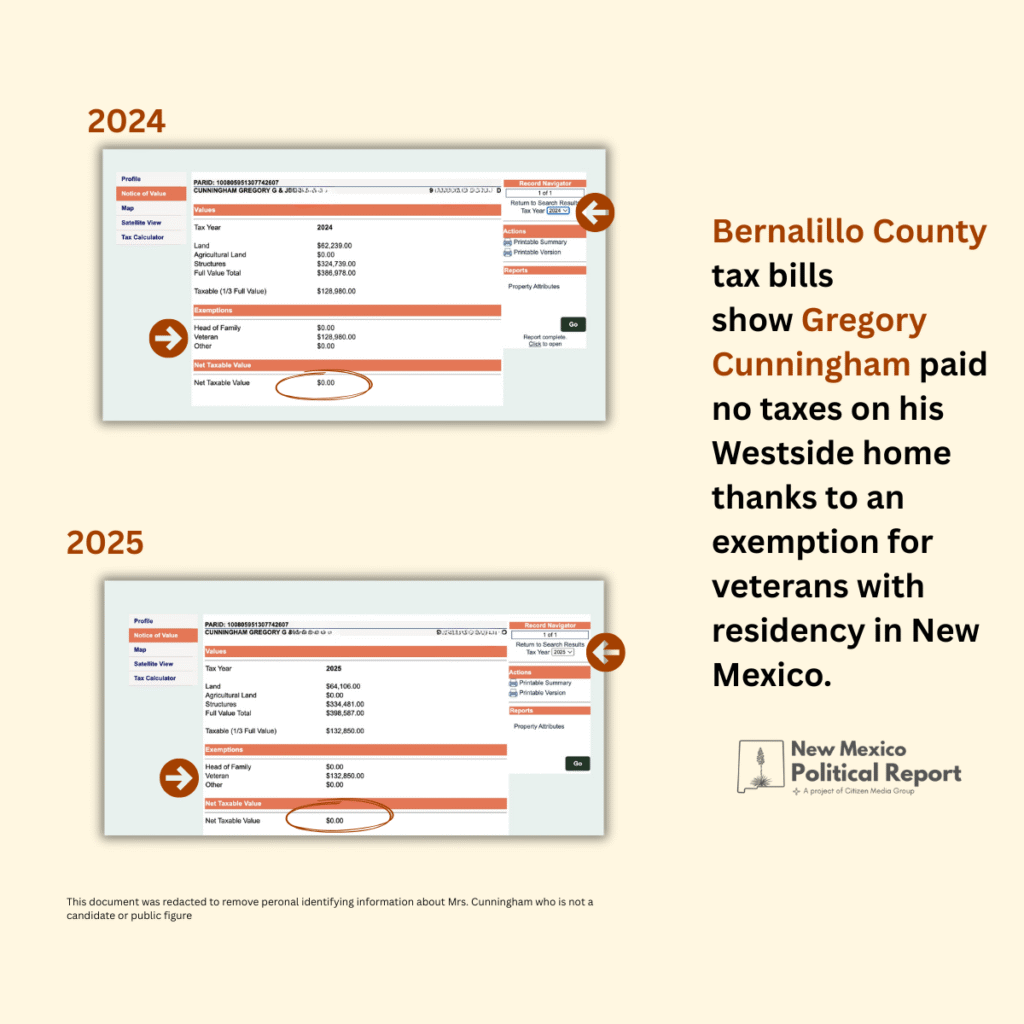

Cunninghams paid zero taxes in New Mexico thanks to veterans’ exemption for residents

Bernalillo County tax records also show the Cunninghams paid zero property taxes in New Mexico in 2024 and 2025 thanks to a property tax exemption available to disabled veterans.

Bernalillo County Assessor Damian Lara told NM Political Report that the exemption is only available on properties if the veteran is a New Mexico resident but eligibility is determined by the State’s Department of Veterans Services. He declined to speculate on whether declaring a primary residence in another state would disqualify a local property owner from the exemption.

Maricopa County tax records indicate that the Arizona home was designated as “primary residence” in 2025 and changed to “rental property” for 2026.

MAGA

Why am I not surprised that a would-be politician hedges his bets to maximize his opportunities on the backs of others?

Isn’t it interesting that republicans who claim to save taxpayers use these benefits for themselves and their buddies but are very constricted (indeed) condemn the democrats who try to avail themselves to such benefits…more for the republicans and less for others…Par for the course….

This makes it clear that Cunningham is only claiming NM residency to run for office, doesn’t it? He’s an AZ scoundrel who doesn’t pay NM taxes and won’t represent us:

“Maricopa County tax records indicate that the Arizona home was designated as “primary residence” in 2025 and changed to “rental property” for 2026.”

Not necessarily, Greta. What it looks like, is the candidate used the primary residence application in Arizona to save tens of thousands of dollars on mortgage costs (closing costs and interest) for a rental property that he would have had to otherwise get a investment property loan for. Some might argue that is defrauding the US Government and taxpayers. Anyone considering a vote for the candidate might think twice.